Sorry if posted already.

According to The Hollywood Reporter, Wang Jianlin (the richest man in China), Google, Apple and Disney are all interested in buying Warner Brothers (which would include DC Comics ).

Now that Rupert Murdoch has withdrawn his $80 billion bid to buy Time Warner, rumors again are heating up about who could make a play for the media giant. Wang Jianlin, founder of real estate giant Wanda Group and China’s wealthiest person, might seem like a dark horse in the sweepstakes. But the opportunity for the ambitious Wang to own an empire as massive as Time Warner could be impossible to resist.

Although a Wanda spokesman tells THR “this is not happening – the takeover of Time Warner does not exist,” several indicators suggest the interest and wherewithal to seal a deal.

Some sources speculate that Wang is eager to expand overseas as a measure of protection against domestic political issues. Wang increasingly has found it difficult to operate on his own terms in China’s highly regulated media world. In July, the country’s version of the SEC denied an application by Wanda Cinema Line for a $320 million offering. Wang shrugged off the rejection, but it showed that he no longer was assured of having things his own way in China.

With a new compound in Beverly Hills, Wang could be a step closer to buying his way into Hollywood.

Three Other Suitors-in-Waiting:

Walt Disney

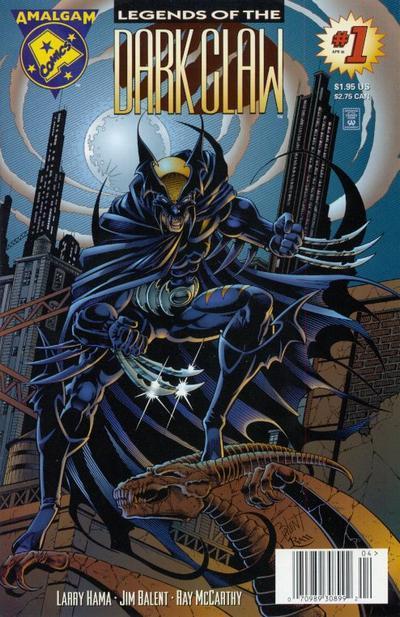

The prospect of combining Disney’s Marvel with Time Warner’s DC Comics might be too compelling to ignore, plus CNN would give Disney the cable news asset it lacks. Disney’s market cap as of Aug. 8 was $149 billion compared with Time Warner’s $63 billion, which gives Disney CEO Bob Iger more leverage than Murdoch might have had.

The search giant most often is mentioned as a potential bidder, though Time Warner still has the historically awful AOL merger fresh in its memory. Still, Google has a track record of massive profits (unlike AOL at the time) and a hefty $385 billion market cap to back up a potential play.

Apple

As with Google, Apple’s massive market cap ($567 billion), not to mention $38 billion in cash on hand, makes it an automatic potential bidder. Time Warner’s giant library of film and TV content presumably would fit neatly into whatever plans the maker of iPads and iPhones has for its still-nascent Apple TV product. And, of course, iTunes always is looking for some video leverage as it goes to war with Netflix, Hulu and other online content services.