Check this. The 1 year high per share was over $8.00 and its low was at about $0.32 so this might look like a bargain now still!!!

Wanted to drop by and thank you for posting a link to this guy. I’ve been watching him start to finish for the last 3 days and he has been an invaluable source of information for me as I get started trading stocks.

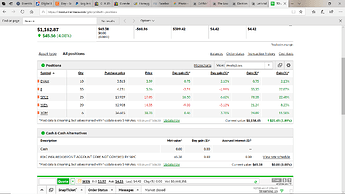

Edit: I’ll be back from time to time to post updates on my progress. I started with exactly $1,000 and this is my portfolio so far:

As to why I have made the decision to dump money into stocks is a story best saved for later, but over time I’ll share the details. For now I’d probably be called a lunatic.

I’m considering purchasing the StockstoTrade from Tim Sykes, has anyone here used it?

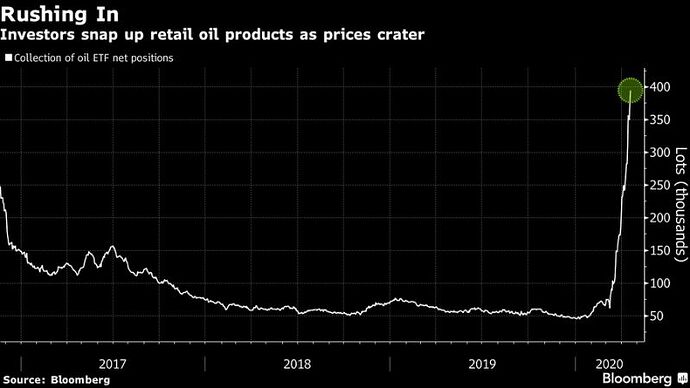

LOL, make up your minds:

https://finance.yahoo.com/news/nowhere-etf-investors-pile-bets-194318142.html

The a few days later LOL:

https://finance.yahoo.com/news/biggest-oil-etf-could-lights-164558632.html

Global markets (stocks, bonds, crypto, etc.) are just giant casinos.

Used that credit repair service @HD-Man mentioned. A month after I sent my dispute letters. I looked on credit karma monday. And saw an account I had in collections and the $6,000 debt completely removed. And a closed credit card account removed from my credit.

Now I dont think I can get the other removed because I made payments on it. So that’s their proof I owe it. But hoping I can get the paid collection for an apartment complex removed.

Awesome u got that stuff off, told ya is was legit. My score is a 712 mid do due Lashanta’s credit service.

Speaking of which, re-financed my car yesterday, due to my credit, my note is $100 less per month with the same contract.

Also joined a credit union to help further build credit. Trynna get 800 and purchase a house in the future ![]()

I still have my credit union account from when I left South Carolina just in case. Rates are often quite competitive.

Indeed, they’re my new lien holders (or whatever the term is). Went from a 22.6% rate of interest with Credit Acceptance to a 2.5. May have to check that 2.5 again, I just know my rate is low and my note is only $240 a month now ![]()

Hahaha, it looks so ridiculous!!! ![]() By the way, it’s a very nice opportunity, thanks a lot for this. But I have some questions. Does it really work? And how much I can earn in a month? Because I’m using a service for free money and I would like to combine it. Free money are always great so I’d like to make much more, of course the service that I’m using is great, but if I can make money while watching different things that’s even greater. So, I’m waiting for the answers. Thanks one more time.

By the way, it’s a very nice opportunity, thanks a lot for this. But I have some questions. Does it really work? And how much I can earn in a month? Because I’m using a service for free money and I would like to combine it. Free money are always great so I’d like to make much more, of course the service that I’m using is great, but if I can make money while watching different things that’s even greater. So, I’m waiting for the answers. Thanks one more time.

Who’s this mother fucker?!?

Just checked credit karma. Transunion credit score reached 645 and experian reached 642. A paid collection i paid 2 years back got removed as well as a closed credit card account with bad payment history.

Only major negative thing left is a collection for 6k. Other than that. Just gotta wait for Some hard inquires to fall off. Gonna get a second credit card to increase my available credit come June.

For some reason there is a 30 point difference between the two credit reporting agencies on my Credit Karma account.

Yeah mine was once like that as well. I believe that’s because due to the different things those two based their score on. The one lagging behind is that way likely because whatever negative report you may have. Hurts that one a lot more than the other.

Or whatever good things you have on your report benefits one score a lot more than the other.

My credit on sites said mine was lower than it actually was. However when I joined the credit union, they reported my credit as a 758 as opposed to a 712

There are many types of credit scores. For the most part, only your FICO scores matter. Doing things that make your scores from other companies better often also make your FICO better, so they’re nice to pay attention to in that sense, but as far as the actual number of the score goes FICO is the one that counts.

Still complicated though, because FICO offers different scores tailored to different industries- slightly different calculations for auto lenders vs credit cards vs mortgages, etc. Plus there are 3 different major credit bureaus who all might have different info on you, so even for a specific type of FICO score you might see 3 different numbers.

Coincidentally, Wall Street is now tanking. OR; there is no such thing as coincidences.

What credit cards do you guys/gals use?

I canceled my AMEX Green because of bullshit. I just have 1 credit card now.

EDIT: a very loose (and I do mean loose) analogy between AMEX and Magic is:

Green: Common

Gold: Uncommon

Platinum: Rare

Black: Mythic

I’m still using basic ass capital one and credit one to rebuild mine. Also say if I wanted to invest in a foreign company such as Rolls Royce as a u.s citizen. Would I still get u.s currency whenever I sell the shares?

I use my Discover IT credit card and just started churning using Bank of America Travel Rewards card. Solid way to get points for a free vacation whenever things get better.

Ok just got back into investing in the market after doing research on how to go about investing. Taking advice from Warren Buffet interviews. Vids and articles on how to read Financials. Haven’t gotten the grasp of 10ks and 10qs yet. But I’ll get there

I’m looking into building a dividen stock portfolio. My goal is to be able to if not live off of dividen payments. Have them be significant enough to afford me to only have to work part time. In the next 10 years. Starting off with a grand. And once I get back to work. Invest 4-500 a month until I’ve paid off my debts. Then invest a 1000 a month