Obama always seemed like a good sport in regards to politics and dealing with opposing parties. Never struck me as a bad guy at all, although some still believe he’s the worst president ever and the anti-christ. I never liked W. Bush’s politics, but I can’t hate the guy either.

the tax code allows for various credits and deductions to whittle down the amount of income you actually pay tax on. also, even if you don’t pay income tax. the bottom 50% are not contributing nothing in taxes. you don’t just pay income tax to the federal government. you also make contributions to SS and medicare via payroll taxes and pay federal excise taxes on specific products, like fuel and alcohol. according to the CBO, the recent rising trajectory in federal debt is mostly due to the tax cut. 1.4 trillion dollars plus interest will bring it up to 1.9 trillion. lol…and you up in here thinking the bottom 50% is the source of the problem.

with their $1.50 raises? lol…i like how he acts like the wealthy are going broke, but a family of four living on 27k is out here balling and bankrupting the country. meanwhile, get caught and fined for fraudulent practices still get the bag thanks to a “middle class” tax cut, brehs.

https://twitter.com/BreakingNews/status/987318219403706369

https://twitter.com/Public_Citizen/status/987340032955568128

lol…no, the first step was to do exactly what they said they would do. invest in stock buybacks and executive compensation. how can you people get finessed by the same game companies ran on bush. shameful.

What do you guys think of ideas like Milton Friedman’s negative income tax or the Basic Income Guarantee (BIG) to replace the current welfare system we have now? I think programs that encourage work and career advancement rather than punish them are a good idea.

There’s too many situations where income can remain stagnant or even decrease as people on our current programs try to push their way out of them. I think the system needs to be looked into.

Just curious as to how you guys feel about this.

North korean soldiers train with russian soldiers and most of their weapons are soviet

Also sk been working with nk for decades to resolve issues

Apparently all those relatives and former officials were not murdered only his brother weird shit

I can’t tell if you’re serious at this point.

What percentage of that “tax easement” (money being taken out of the treasury) is being returned to workers?

Businesses are in business to make a profit at the expense of all else including workers: that’s their goal. If you’re talking about somebody being worth “more hours”, that’s great for the corporation who doesn’t have a commitment to that hourly worker (retirement plan?), will try to underschedule that person to avoid needing to pay them benefits, and will probably underpromote them to extract the most value out of them. Businesses are naturally predatory: government and unions are the two most logical ways of keeping that in check.

So, no, that’s not a counterpoint. It doesn’t have anything to do with the concept, really.

No, that time-tested mechanism is not bankrupting our country. The new-ish mechanism from the Reagan era of “Starve the Beast” is bankrupting our country. If you cut funding without correspondingly cutting expenditures, you’re going to have problems. If you create expenditures (Iraq?) without raising funding, you’re going to have problems.

20 trillion in debt in isolation is meaningless, much like most numbers. I would suggest that it indicates that the current government is making bad choices. We can fix that, but doing shit like giving out a massive tax corporate cut buttressed by delicious and sugary temporary individual tax cuts seems to make the problems our country faces worse not better.

I like roads, I like education, I like mental health services, I like residential services, I like power, I like … appreciate a semi-functional justice system, I like support for business opportunities, I like protection from predatory peoples and business, I like support for people who currently can’t handle life, I like a lot of things that a functional government affords us.

I read that our government pays around $310 billion a year in interest on the debt. That’s a lot of money thrown in the garbage. It really should be a priority to pay this down.

Like I don’t care that Kanye is going all Get Out and he is entitled to his moronic opinion but why is he not being told to shut up and sing? Or why is he not being treated like Eminem was?

Like we get it fucking Kardashians and sex tapes are not all the rage anymore…

https://twitter.com/kanyewest/status/989272340432240641

See the problem is he stupid and a liar as Trump. Obamas pet project was just this and guess who on day 1 ended it…

I’m just surprised that Fox News hasn’t told Kanye to “shut up and rap” or “keep out of politics”

Bill Cooper: "I have not filed an income tax return since 1986 I think — '85 or '86.

…

You see I’ve done the reasearch, I can’t find any law. I sued the IRS to force them to show me why I should — THEY COULDN’T DO IT!

…

…and that’s the reason they issued the warrant for the arrest of my wife and myself, in order to stop that lawsuit — 'cause THEY WERE LOSING."

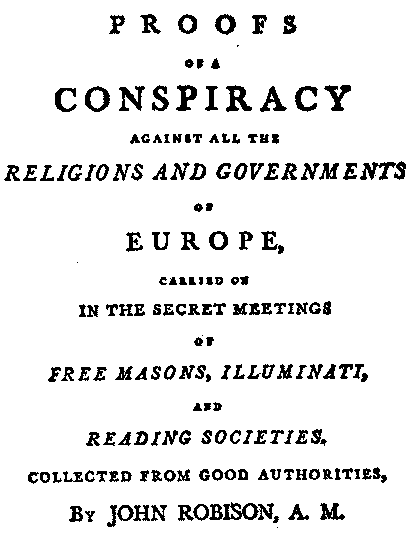

(1798)

(1967)

"The question of how and why the United Nations is the crux of the great conspiracy to destroy the sovereignty of the United States and the enslavement of the American people within a UN one-world dictatorship is a complete and unknown mystery to the vast majority of the American people.

…

We all know that our State Department, the Pentagon, and the White House have brazenly proclaimed that they have the right and the power to manage the news, to tell us not the truth but what they want us to believe. They have seized that power on orders from their masters of the great conspiracy and the objective is to brainwash the people into accepting the phony peace bait to transform the United States into an enslaved unit of the United Nations’ one-world government.

…

However, the vitally important thing for all Americans, all you mothers of the boys who died at Korea and are now dying in Vietnam, to know is that our so-called leaders in Washington, who we elected to safeguard our nation and our constitution, are the betrayers and that behind them are a comparatively small group of men whose sole objective is to enslave the whole world of humanity in their satanic plot of one-world government."

…

In order to infiltrate into Masonic Lodges in Britain, Weishaupt invited John Robison over to Europe. Robison was a high degree Mason in the Scottish Rite. He was a professor of natural philosophy at Edinburgh University and Secretary of the Royal Society of Edinburgh. Robison did not fall for the lie that the objective of the Illuminati was to create a benevolent dictatorship, but he kept his reactions to himself so well that he was entrusted with a copy of Weishaupt’s revised conspiracy for study and safekeeping. In order to alert other governments to their danger, in 1798, Robison published a book entitled ‘Proof of a Conspiracy to Destroy all Governments and Religions’ but his warnings were ignored, exactly as our American people have been ignoring all warnings about the United Nations and the Council on Foreign Relations (the CFR)."

Why would I blame Taft, when Wilson was the one that signed it into law.

Taft is still an enemy though. Taft was a Skull and Bones member — the American Branch of the Illuminati. All Skull and Bones members are enemies of America.

Tim Russert: You were both in Skull and Bones, a secret society.

George Bush Jr.: It’s so secret we can’t talk about it.

Tim Russert: What does that mean for America? The conspiracy theorists are gonna go…

…

Tim Russert: You both were members of Skull and Bones, a secret society at yale. What does that tell us?

John Kerry.: Not much 'cause it’s a secret.

Tim Russert: Is there a secret handshake, is there a secret code?

John Kerry.: I wish there were something secret I could manifest…

Tim Russert: 322 - secret number?

John Kerry.: There are all kinds of of secrets Tim…

[spoiler] [/spoiler]

[/spoiler]

mr_punk: according to the CBO, the recent rising trajectory in federal debt is mostly due to the tax cut.

You’re full of crap. According to the CBO (https://www.cbo.gov/publication/53781):

“That pattern of deficits is expected to occur mainly because, under current law, revenues and outlays would grow at different rates. Revenues would be roughly flat as a percentage of GDP over the next several years before rising steadily in the second half of the period. In contrast, outlays would increase in most years through 2028.”

The rising debt is due to spending, not taxes. Clearly, we can’t tax out way out of this debt, since tax revenue is going up after the tax cuts: raising taxes would LOWER tax revenue (if this concept confuses you, read up on the laffer curve). Even so, the increase in tax revenue isn’t outpacing spending.

As any economist worth their degree would say: the government needs to cut spending, especially entitlement spending: which is the primary cause of our expanding debt.

That doesn’t seem to say that he’s full of crap. The CBO says that the problem is due to the difference between spending and taxes. How do you unlink the two? Why do you unlink the two?

Why are entitlements so sexy of a target? We just don’t like people that struggle? I mean I don’t like mashers either, but it seems ridiculous to claim that “not helping the fucked” is a better plan than “taxing high wealth accumulation in order to better society and help the fucked”.

I don’t really recall any recent analysis saying that entitlements are the problem, but we probably drink from different informational firehoses. Governments and societies are complicated, but I have a hard time believing that experts would espouse theories that abandoning segments of society leads towards a better society. That’s some ignorant Ayn Randian “I made this all by myself” bullshit.

I think most of us would agree that the recession is over correct?

And that for a time it may have been acceptable to increase entitlement spending while we were in the recession.

So now that the recession is over, and the unemployment rate is at a 40 year low, why would it be so far fetched to go back to pre-recession entitlement spending levels?

We’ve already suggested that we compromise and decrease military spending. So we’re losing something too. However you don’t want to compromise. You don’t want to concede or work with anyone. So why should anyone take you seriously?

I’m unclear what that apparently loaded statement means as regards that ‘the recession is over’. Sure, but the aftereffects of events do tend to ripple forward and need tending to. There’s no magic one-shot pill on any issue in politics.

… ? What percentage of the response to the recession was entitlement spending? What propaganda are you listening to wherein that was the major government response to the recession?

I’d countersuggest that America had and has a problem with capitalistic medicine, and that while we’ve started working on part of it there is a long long way to go before the system is healthy.

I’m unclear as to what benefit would be gained by cutting entitlement spending. Is this the Ayn Randian “every man is an island” talking? In theory you want everyone to succeed. You need to give people paths to success, and it shouldn’t just be “well my parents had enough money to buy a house” or “I got really lucky in my career choice/life skills”.

If your economic plan is to only curtail spending in any one area, I’d suggest you should go study the field more. It’s a gigantic unruly interconnected web of a system, and the ripple effects of everything get to be fascinating. It’s almost like it’s a field of study. It’s almost like the gubbermint could just say “hey let’s cut military spending” if that was the real and brilliant choice and solve all the problems… but they don’t because it doesn’t.

I don’t want to concede or work with anyone? News to me. I don’t want to compromise? News to me. You don’t want to take me seriously on political discussions? Awesome: I think you’re probably an awesome person in real life but I’m happy to discuss the news of the day with the other peoples here and leave you out of my conversations. <3

You know the message might be slightly more receptive if you stop being a condecending fuck and calling it entitlements.

Just a thought.

Preppy That doesn’t seem to say that he’s full of crap. The CBO says that the problem is due to the difference between spending and taxes. How do you unlink the two? Why do you unlink the two?

How do you unlink spending and taxes? Because revenue and expenses ARE two separate things that can be changed independent of each other. Technically, they arn’t linked at all. As for the question of “why”, thats a question you will have to ask to the science of economics as a whole.

Why are entitlements so sexy of a target?

It’s not a matter of “sexy”, the exponential increase in US government spending in recent years and projected is primarily from entitlements. Period. You may not like it, but it’s true.

As for the rest, again, I’m just stating the truth. You can strawman (ex: “not helping the fucked”), appeal to feelings, and believe lies like we can tax your way out of this , but it doesn’t curb reality.

If you want to have an honest discussion about the state of the US economy, we need to face the elephant in the room:

Entitlements.

(and to those who are triggered over this term, thats a personal problem that changing the term isn’t going to solve)

Technically, they arn’t linked at all.

I’m puzzled by your comments that don’t seem to be in relation to the CBO document that we were pointed at where they were explicitly mentioned as being in lockstep. I’ll move on, as it seems like you’re talking about something unrelated to what I said.

It’s not a matter of “sexy”,

Again, it looks like you’re cherry-picking my comment that was made in relation to a discussion of a CBO document.

“not helping the fucked”

I feel that there are people who need assistance, will need assistance, and may in fact be beyond the capability of bootstrapping themselves into an semblance of a normal life. I will call those “the fucked” because it’s a pretty pointed way of noticing that they exist. I am using that term to point out the ignorance embedded in the discussion. If someone doesn’t think there are some people that are just fucked, I don’t believe them because I think people get out enough to notice the world around them.

believe lies like we can tax your way out of this

I’m unclear where I’ve ever said that. I do believe taxes are a critical thing, and are usually a good thing for the government and hopefully society.

The pressure clearly has been to cut taxes. But if we’re not correspondingly cutting spending, and it is evident that we have not been, then we are crafting extremely warped policy. Given the state of the world, it seems that raising taxes is probably logical. That being said, the economy is a delicate fucking flower, and if you misunderstand this and think that “we can tax our way out of this” then you’re an idiot.

Entitlements

… is this high school civics? Yeah, society is a troubled lumbering thing, and everything caught up under the pointlessly gigantic umbrella term of “entitlements” is usually a mess as you try to sort out the problems of advancing society generically. If you want to have any sort of meaningful discussion, be specific. Absurd sweeping statements appeal to people who probably have no place anywhere near positions of power . Starve the beast, cut the fat, drain the swamp, income tax is illegal, entitlements are the devil, taxes are the answer, lock her up, blah blah. Lots of stupid shit we can say or talk about if we really don’t have a clue in our head.

I prefer to believe everybody here is smart and that we don’t need to go through the Cliff’s Notes version of how government works. <3

I feel like a lot of your discussion is predicated upon either you not understanding government or presuming that the other person has no understanding of government. Why bother? Anybody who has such a bad misunderstanding of governance so as to believe the positions you put forth for others is an idiot not worth talking to. If you need clarification on what somebody else believes, it seems more honest to ask than to assume that they are brain-damaged.

lol…uh oh, trump stans already all up in their feelings over their cult leader. FYI, your link isn’t the cbo report. it’s a link to a blog post about the cbo report and not the report itself. here is the link to the actual report which is far,far more in-depth and if you read it you would have seen this:

[spoiler]

Deficits Are Projected to Be Larger Than CBO Previously Estimated

The deficit that CBO now estimates for 2018 is $242 billion larger than the one that it projected for that year in June 2017. Accounting for most of that difference is a $194 billion reduction in projected revenues, mainly because the 2017 tax act is expected to reduce collections of individual and corporate income taxes.

For the 2018–2027 period, CBO now projects a cumulative deficit that is $1.6 trillion larger than the $10.1 trillion that the agency anticipated in June. Projected revenues are lower by $1.0 trillion, and projected outlays are higher by $0.5 trillion.

Laws enacted since June 2017—above all, the three mentioned above—are estimated to make deficits $2.7 trillion larger than previously projected between 2018 and 2027, an effect that results from reducing revenues by $1.7 trillion (or 4 percent) and increasing outlays by $1.0 trillion (or 2 percent). The reduction in projected revenues stems primarily from the lower individual income tax rates that the tax act has put in place for much of the period. Projected outlays are higher mostly because the other two pieces of legislation will increase discretionary spending. Those revenue reductions and spending increases would result in larger deficits and thus in higher interest costs than CBO previously projected.

In contrast, revisions to CBO’s economic projections caused the agency to reduce its estimate of the cumulative deficit by $1.0 trillion. Expectations of faster growth in the economy and in wages and corporate profits led to an increase of $1.1 trillion in projected tax receipts from all sources. Other changes had relatively small net effects on the projections.

[/spoiler]

TLDR I: cut taxes, lose money, breh.

TLDR II: tax cuts do not pay for themselves, breh.

clearly? lol…clearly, the cbo disagrees with you. clearly, the GOP sold this tax cut to ill-informed people like you based on the lie that tax cuts would pay for themselves with large increases in economic growth and revenues. however, when the bill passed. the GOP started copping pleas about how they needed other policy changes for the plan to actually work. which explains why you’re up in here copping pleas like a struggle version of paul ryan or steve mnuchin not that i mind. i think it’s funny.

also, watching you cosign some dumb shit like the laffer curve is pretty hilarious too. art laffer’s pockets stay swollen by finessing ducks with the same game since the 80’s. but hey, you’ll fit right in around here between the flat earthers and the conspiracy theorists.

you basing your entire argument on your inability to read the correct cbo report? i agree. it’s a problem for you.

speaking of clowns, did anyone catch the performance of trump stans, Diamond and Silk in the GOP judiciary committee hearing called, “Filtering Practices of Social Media Platforms"? these two tin-foiled clowns are claiming to have been censored by facebook because of their conservative politics. ted lieu summed up the whole hearing pretty well.

https://twitter.com/kylegriffin1/status/989548571878883328

of course, it never takes long for trump stans to make fools of themselves and start copping pleas.

https://twitter.com/ABC/status/989544265607929856

transcript of the exchange:

[spoiler]

JEFFRIES: I think you stated on the record today, at least three times, quote, we were not paid by the Trump campaign? Is that correct?

HARDAWAY: That is correct. …

JEFFRIES: The FEC report dated May 12, 2017, states that on Nov. 22, 2016, the campaign of Donald J. Trump for President, Inc. paid “Diamond and Silk” $1,274.94 for “field consulting.” Are you familiar with that?

RICHARDSON: We’re familiar with that particular lie; we can see that you do look at fake news. …

JEFFRIES: Are you calling this FEC document fake?

RICHARDSON: No, we’re not calling it fake. …

JEFFRIES: Presumably this was a document filed with genuineness and authenticity by the campaign of the president that you so love. And so I’m just trying to figure out who is lying here? Is it the Trump campaign, or is someone not telling the truth?

RICHARDSON: Nobody is lying. However, there may have been a mistake from the Trump campaign whenever they wrote what the $1,274.94 was for. Actually, this was for — we were asked to join the Women for Trump tour back in 2016. And Ms. Lara Trump asked that our airline tickets be refunded back to us because we paid for those tickets when we went from New York to Ohio.

[/spoiler]

speaking of tax cuts, The Joint Committee on Taxation released a report outlining some of the effects of the “pass-through” tax deduction . unsurprisingly, the deduction which claims to help “small businesses” does nothing of the sort. basically, it mainly benefits corporations and rich people by showering them with huge tax breaks that can be gamed. FYI, trump businesses are pass-through.

https://twitter.com/ScottElliotG/status/988862494696464385

https://www.jct.gov/publications.html?func=startdown&id=5091

orrin hatch response to the report is hilarious.

https://twitter.com/ScottElliotG/status/988849413035524097

https://twitter.com/ScottElliotG/status/988850056626401281

https://twitter.com/ScottElliotG/status/988850856916332544

lol…the same orrin hatch who is fine with giving warren buffett a $29 billion dollar tax cut (“A large portion of our gain did not come from anything we accomplished at Berkshire, said buffett”),but loses his shit and starts copping pleas when it comes to funding CHIP which costs far, far, far less than buffet’s tax cut.

![Myron Fagan exposes the Illuminati/CFR [1967]](https://archive.supercombo.gg/uploads/default/original/3X/2/f/2f457a988ab911d708e264513ed1bc23edc12199.jpeg)